Bumble vs. Match: A Long/Short Strategy in the Dating App Market

Leveraging Relative Value to Capitalize on Market Dynamics Between Two Leading Dating Platforms

Hello Everyone,

We're back with another GOLD Subscriber Long/Short Idea. This one has been in the works for a while, and it seems the time might be right to take action.

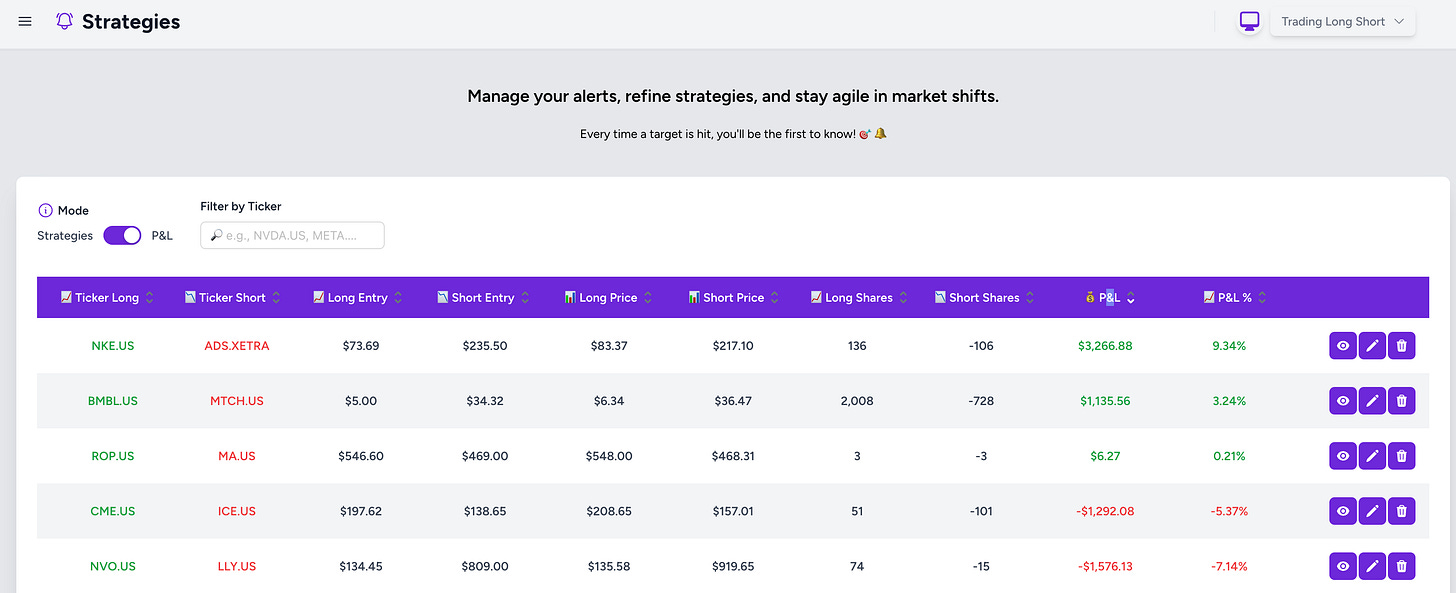

Before we dive into the new Long/Short opportunity, let’s review some of the previous strategies we've discussed:

- NVO / LLY

- CME / ICE

- NKE / ADS

Also, don’t forget that you can now track all your strategies using our new functionality.

We remain confident that our previous Long/Short strategies continue to align with the analyses presented in earlier GOLD articles. Both the NVO/LLY and CME/ICE trades may require additional time to reach their potential, particularly the latter, due to evolving competitive dynamics with BGC Group BGC 0.00%↑ .

With that brief update on prior strategies, let’s turn our attention to this month’s Pair Trade.

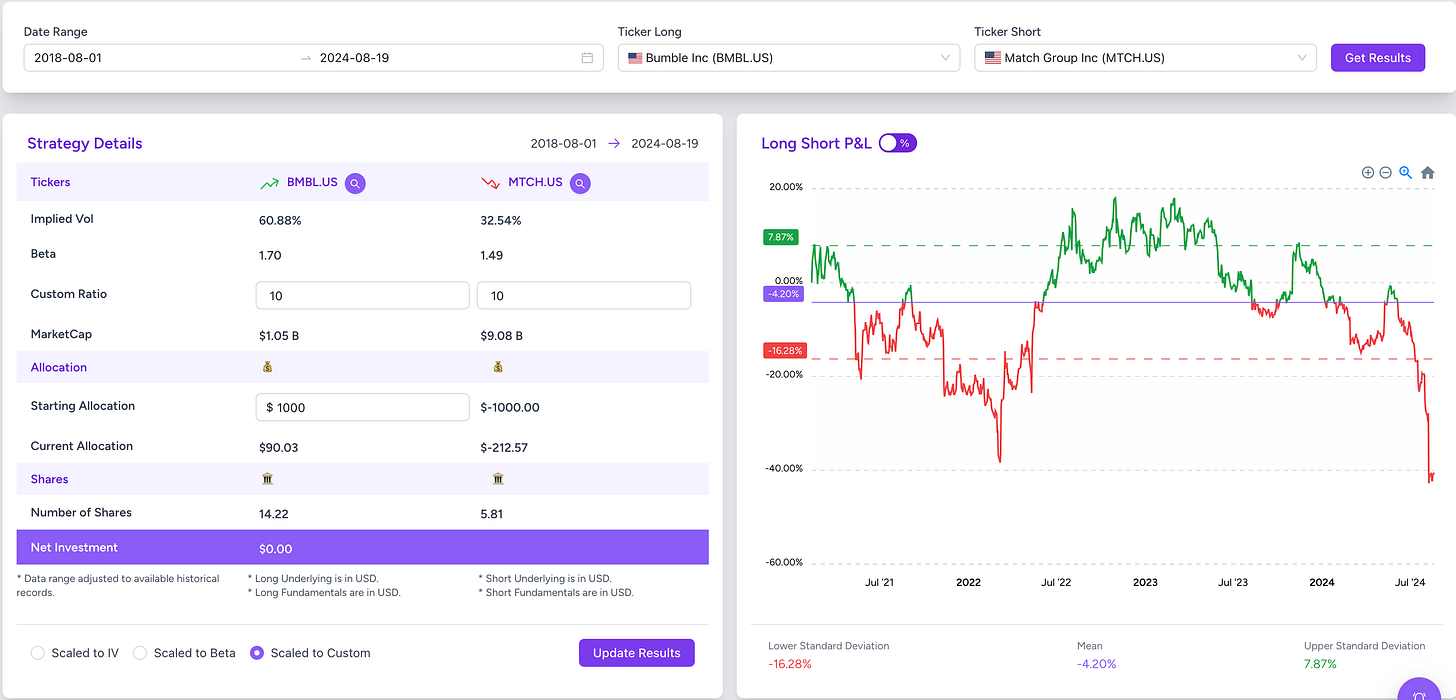

This month, we observed a significant 40% drop in one day following BMBL 0.00%↑ earnings report. The company issued weak guidance and reported declining ARPU across its key apps.

As anticipated, the pair we’re recommending includes Match Group MTCH 0.00%↑ , the parent company of Tinder, Hinge, and other leading dating platforms worldwide.

This represents the most significant divergence between these two stocks that we have observed historically.

Historically, both stocks have exhibited behavior that tends to move in tandem. Since BMBL 0.00%↑ IPO, the companies have closely tracked each other’s performance.

Given that our focus is on a relative value strategy, it’s crucial to concentrate on the differences between the companies rather than industry-wide threats. In a higher rate environment, with expectations of rates staying elevated for longer, a highly leveraged company may see its stock performance diverge significantly from that of a less leveraged competitor.

It is, therefore, essential to ensure that Match Group is not significantly overvalued relative to Bumble, and that the recent divergence is not a reflection of increased bankruptcy risk.

Currently, Match Group trades at a valuation 10 times higher than Bumble, despite having an EBITDA only about 3 times larger.

Match Group’s EBITDA is approximately $70 million per quarter and is expected to remain at similar levels throughout the year. The company has around $300 million in cash and just over $600 million in debt. Additionally, management has expressed intentions to ramp up stock buybacks during the recent earnings call.

On the other hand…

Match Group, on the other hand, has approximately $1 billion in cash and nearly $4 billion in debt. The company has also been actively conducting buybacks in 8 out of the last 9 quarters.

The recent 40% drop in Bumble's stock price was likely exacerbated by liquidity constraints and options dynamics. After the earnings report, call open interest for Bumble surged significantly. Prior to the earnings announcement, there were notable spikes in out-of-the-money (OTM) puts, indicating heightened market volatility.

These factors, coupled with gamma dynamics, likely contributed to a technical sell-off in a low liquidity environment. The stock, which had fallen to $4.70 per share, has since rebounded to approximately $6.20, marking a 35% increase from its lows.

On the day before the earnings report, 4 million puts were traded, with a total notional value exceeding $70 million in a stock with a $1 Billion market cap.

Additionally, on August 8th, 100,000 contracts were traded with a notional value of $63 million in a company valued at $700 million, representing roughly 10% of the company’s market cap. This was preceded by a significant put spike on June 12th.

We believe that both Match Group and Bumble could be compelling M&A targets for companies such as AAPL 0.00%↑ or META 0.00%↑. However, given the long-term correlation between these two stocks and the high probability that the recent divergence stems from technical option factors, this situation may present a very attractive Long/Short opportunity.

At the time of this writing BMBL 0.00%↑ is trading at 6.35 and MTCH 0.00%↑ is trading at 36.50$.