The Adidas and Nike: Giants of the sports footwear and clothing market.

This article was written in April 23rd 2023

Adidas (ADS) and Nike (NKE) are two of the world's biggest sports footwear and clothing brands. Both have a wide range of products and are known for their innovative design, cutting-edge technology, and sponsorship of renowned athletes. They are companies in the Consumer Discretionary sector of the sports footwear and clothing industry.

Nike: Market leader recognized for innovation and sponsorship of high-performance athletes

Nike, Inc. is an American multinational sports footwear and clothing company headquartered in Beaverton, Oregon. Nike is considered one of the most important and recognized fashion brands in the world. The company was founded in 1964 as Blue Ribbon Sports and later changed its name to Nike, Inc. in 1971.

Nike has a broad global presence and is seen as the leading brand in the sports equipment market. Its presence is very strong in high-performance sports, including basketball, athletics, and tennis. It has a solid presence in the sports clothing market and a strong online presence. Nike is also known for its impactful advertising campaigns and its association with the slogan "Just Do It".

Adidas: Brand recognized for quality and innovation, strong presence in the football market and partnerships with fashion brands

Adidas AG (DAS - Frankfurt) is a German sports footwear and clothing company. Founded in 1949, Adidas is one of the most recognised and respected brands in the sports goods market.

Adidas has a global presence, with subsidiaries and stores around the world, and is known for its high-quality and innovative products. In addition, Adidas develops various sports partnerships and sponsorships, which helps to further increase its visibility and credibility in the market.

Adidas is stronger in Europe and has a strong presence in the football and athletics markets. It has invested in its fashion line to expand its customer base, examples of which are partnerships with Stella McCartney or Jenna Ortega or with the brands Balenziaga and Gucci. It also carried out what seemed like a successful collaboration with the American rapper Kanye West on the Yeezy line, which became one of the most sought-after brands in the market, but this partnership ended at the end of 2022.

End of the Yeezy partnership with Kanye West will affect Adidas' revenue by € 500M

It is important to delve into this specific Yeezy line. Yeezy was a collaboration between Adidas and rapper Kanye West. Since its creation in 2015, the Yeezy line has become known for its unique style, futuristic aesthetics, and innovative silhouettes. The line included a wide range of products, and the collaboration was a major commercial success for both brands. This line was known for highly limited releases, which often caused anticipation and excitement among fans.

Why did it end????? Paragrafo

After so much success, putting an end to this partnership was a very difficult decision and had an obvious immediate impact on the business.

“I can confirm that adidas is the sole owner of all design rights, ready to existing product as well as previous and new colorways under the partnership, and we intend to make use of these rights as early as 2023. Let's have a more detailed look on the incremental Yeezy business. Given the high seasonality of the Yeezy business, where we are typically generating around 1/3 of the total annual revenues and almost 40% of the annual profit contribution in Q4, we expect the revenue shortfall related to the immediate termination of the partnership of around €500 million Euro.”

Management confirms that they own the intellectual property rights of the partnership, as well as ownership of the colours and patterns. Management expects to take a closer look at what remains of the partnership.

Challenges of the market: Strong dollar, conquering the Chinese market, focus on e-commerce, and reducing stocks.

This market in the current context identifies some concerns, and it is normal for both management teams to identify most of the problems as common:

• The strong dollar is a fundamental problem that affects Nike. This scenario could be an advantage, but as China is the most attractive market, the strong dollar can represent a risk due to the high devaluation of the Yuan (~7X).

• Conquering the large Chinese market as a short/medium-term objective. Increasing market implementation and the need to recover sales, whether through marketing campaigns, sponsorship of major sporting events, or through influencers.

• Increasing focus on e-commerce growth, as it is vital for brands to have direct contact with consumers. Strong brands, respected and with great loyalty, whether in technical products already recognized in sports areas or through the impact of brands in fashion, end up benefiting.

• Reducing stocks, both aim to aggressively and effectively reduce their products in stock. Particularly clothing lines, although resorting to discounts can have a strong impact on results, given the cost base they start from is quite advantageous.

In summary, Nike and Adidas are two successful sports equipment companies, each with their own strengths. They also share the same market, as despite Nike being considered the number one brand, Adidas is clearly the second strongest sports brand, so it is normal to face similar difficulties. They are competitors and regardless of their size, the competition is fierce.

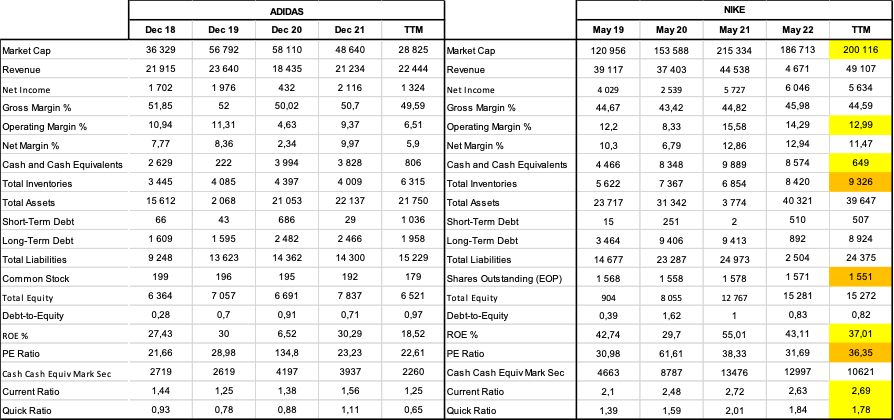

They present solid balance sheets and results.

Nike and Adidas have a solid balance sheet. Based on data from the past 12 months, the short-term and long-term loans taken out, compared to the total equity, result in a Debt/Equity ratio of 0.46 for Adidas and 0.62 for Nike. When comparing total debt to the previous fiscal year's operating profit (2021), it would take about 1.5 years to pay off the outstanding debt. Both metrics are not a cause for concern. Additionally, the companies have €806M (Adidas) and $649M (Nike) in cash and cash equivalents on the balance sheet.

Adidas trades at 23 times earnings, while Nike trades at 32 times earnings, showing the market's confidence in the companies' ability to generate results.

The companies' operating margins reveal part of the difference between Nike and Adidas. There is a greater weight on R&D and operational costs at Adidas, which puts it at a disadvantage. However, in this industry, R&D is essential as it is the reason for the notoriety and growth of the brands in the world of high-performance sports, where technology makes the difference in choice.

The only major problem at the moment is the high levels of inventory, which have increased to €6.315M (Adidas) and $9.326M (Nike). Inventory levels have always been high in the past few years, but it did not warrant a drastic reduction in value. This position is due to the Risk-Free rate. With the increase in the risk-free rate, the value "stuck" in inventory represents a "loss" of several million Euros and Dollars. Considering a risk-free rate of 3.5%, the opportunity cost of holding stocks is €221M for Adidas and $326M for Nike, which is significant.

However, the companies expect inventory levels to normalize during 2023, as both companies intend to aggressively clear excess stock and tactically reuse existing stock. In fact, in line with this premise, Adidas does not intend to create a new line of products in 2023. Instead, they prefer to sell the stock during this period, even if they have to resort to discounts. The management sees it as advantageous because the cost basis they are starting from comparatively with the current one proves advantageous.

Regarding dividends, we can see that at Nike, its value is minimal compared to the Dividend Yield. And when analyzing the Payout Ratio, we see a small value, indicating that the company reinvests its profits into the business.

Adidas, on the other hand, is more attractive in terms of dividends, as it has been paying dividends since its IPO in 1995. However, it did cut its dividend once due to COVID-19 and the market instability caused by the shutdowns. Although it has not increased the dividend every year, it can be seen as a stable dividend payer.

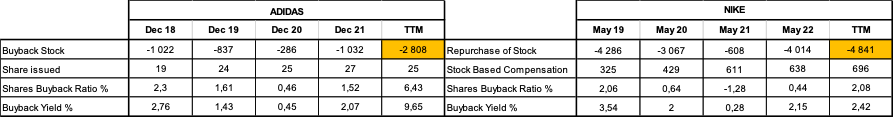

An important factor to consider is the companies' stance on share buybacks.

Adidas has aggressively reduced the number of outstanding shares, which seems like a good move given the low stock price. In December 2021, management launched a multi-year share buyback program and has been using the opportunity effectively. Adidas has reduced the number of outstanding shares from 193.2 million to 179.2 million, taking advantage of the drop in share price, and has increased the buyback ratio. However, it should be noted that the company financed €25 million through the issuance of new shares.

On the other hand, Nike has also engaged in buybacks, but to a lesser extent. Additionally, there is a Stock Base Compensation program for management, so part of the buyback corresponds to the delivery of shares to management. Adidas has spent €2.8 billion on buybacks, while Nike has spent $4.8 billion. However, Adidas has recovered 6.43% of its free float, while Nike has only managed to recover 2.08% of its free float. Both companies have used their cash reserves to finance the buybacks.

Conclusion

Starting from the post-COVID recovery in March 2020, we saw a sharp divergence in the stock prices of the two companies. While Nike rose by 66%, Adidas fell by 14.7%.

Since the November 2021 highs, and following the market trend, Adidas and Nike began a strong and relatively correlated correction. By September 2022, both had fallen around 50%, but at that time there was an inflection point only registered in Nike. Adidas continued to fall until reaching a 72% drop from its highs.

This accentuation of the decline in Adidas coincides with an interview given by Kanye West to Bloomberg, where he states that he intends to go solo and end various partnerships. He himself affirms, "No more companies standing in between me and the audience".

If we observe over a slightly longer term (10 years), we see that even though there may be a deviation in certain points of the stock prices, they tend to converge, which is normal given the market they compete in and their similar characteristics.

These companies base their marketing strategy on bold and impactful campaigns and partnerships with prominent athletes, clubs, federations, teams, as well as designers and influencers.

The possibility of a partnership withdrawal or an ill-advised action that leads the brand to not want to be associated with a certain figure is a situation evaluated and considered by the market. While it is impossible to predict when it will happen, it is certain that it is possible to happen to any company in this industry. Therefore, despite the initial impact, the market will continue to observe the results and potential of the companies, and over time, ratios, metrics, and mainly results will outweigh this setback with immediate impact on results.

This divergence supports our view that there will be a real convergence of quotes, hence we see a possibility of a Long-Short, Long Adidas and Short Nike. "Long-short" is an investment strategy that combines "long" and "short" positions. The "long" position is a bet that the price of an underlying asset will increase, while the "short" position is a bet that the price will decrease. The long-short strategy allows investors to capture gains in both rising and falling markets, while mitigating risk, as losses in "long" positions are offset by gains in "short" positions.

The long-short strategy seeks to eliminate market risks, taking into account the Betas (1.1 Nike; 0.79 Adidas) and IVs (27% Nike; 41% Adidas) of the aforementioned stocks, aiming for the strategy to be as clean as possible regarding market risks.

It's interesting that if we look to the past to predict future behavior, we find a higher Beta in Nike and a lower one in Adidas. Nike effectively followed the market trend while Adidas diverged and amplified the decline.

However, in attempting to predict future behavior with a forward-looking perspective, Nike's IV is lower than Adidas', indicating that the market anticipates lower volatility in Nike and higher volatility in Adidas, also due to the recent amplified decline.

The long-short strategy has the ability to restrict market risk. If the two stocks resume their decline but reduce divergence, the investor wins. If, on the other hand, both stocks rise but reduce divergence, the investor still wins.

Lastly, another alternative, and the most positive, is if Adidas confirms its recent upward trend and accelerates to approach Nike, or if Nike helps and also moves towards convergence, the investment reaches its end and provides a profit for the investor.

An example for a €5,000 investment would be to short 40 shares of Nike and long 32 shares of Adidas.