Strategic Opportunities: Evaluating Nike and Adidas L/S Amidst Changing LTIP Dynamics

Hello fellow gold subscribers!

Here’s our July 2024 Pair Trading Idea.

We are all familiar with Nike and Adidas for their high-quality sneakers and sportswear. The correlation between their stock performances is evident and can be observed in the market charts. Over a year ago, we discussed a long/short strategy after Kanye West's public comments significantly impacted Adidas' sales, particularly through the popular Yeezy line.

The Adidas and Nike: Giants of the sports footwear and clothing market.

This article was written in April 23rd 2023

More than a year later, a new pair trade opportunity has emerged with these two stocks once again. This time, Nike appears to be relatively cheaper compared to Adidas.

Nike, the world’s largest sportswear company, has experienced a mid-single-digit revenue decline in the current fiscal year, contrary to investor expectations of an increase.

It's plausible that the guidance provided by Nike's management team is influenced by the Long Term Incentive Plan (LTIP) approved in 2020, which expired in 2023. This year, there is an upcoming vote on a new LTIP for the executive team at the annual meeting.

These LTIPs are typically tied to stock performance and other operational metrics.

On the other hand, Adidas has an active Long Term Incentive Plan (LTIP) that is set to expire only in 2025.

The LTIP 2021/2025 pursues the goal of aligning the long-term performance-based variable remuneration of the Executive Board with the performance of the company and thus with the interests of the shareholders. Against this background, the LTIP 2021/2025 is share-based. It consists of five annual tranches (2021 to 2025), each with a term of five years. Each of the five annual tranches consists of a performance year and a subsequent four-year holding period. For the 2021/2025 LTIP, the Supervisory Board has set financial and ESG-related performance criteria for each of the five performance years.

Adidas Annual Report 2023

The fundamental decline this year for Nike has been primarily linked to decreasing revenues and lowered guidance. Nike CEO John Donahoe attributed the downturn to drops in lifestyle sales and uncertain macroeconomic conditions, leading the company to cut its guidance for fiscal year 2025.

Last year, Adidas posted revenues of €21.3 billion, while Nike reported $51.3 billion. In terms of market capitalization, Nike is currently valued at approximately $115 billion, roughly 2.2 times its sales, while Adidas stands at €45.5 billion, also around 2.2 times its sales.

As of this writing, Adidas Euro corporate bonds are trading at around a 3.0% yield, whereas Nike's USD-denominated bonds are trading at around a 5.0% yield.

However, Adidas appears to be more leveraged than Nike. Negative developments in the business could have a higher multiplier effect, potentially amplifying the impact of any adverse events.

Adidas has a net debt position of around 4B$ euros while Nike has a net debt position closer to zero.

We believe that both companies are highly exposed to similar risks, and their stock performance may be influenced by overly negative guidance from the management teams. This could be a strategic move to maximize the new stock-based compensation packages set to be approved later this year.

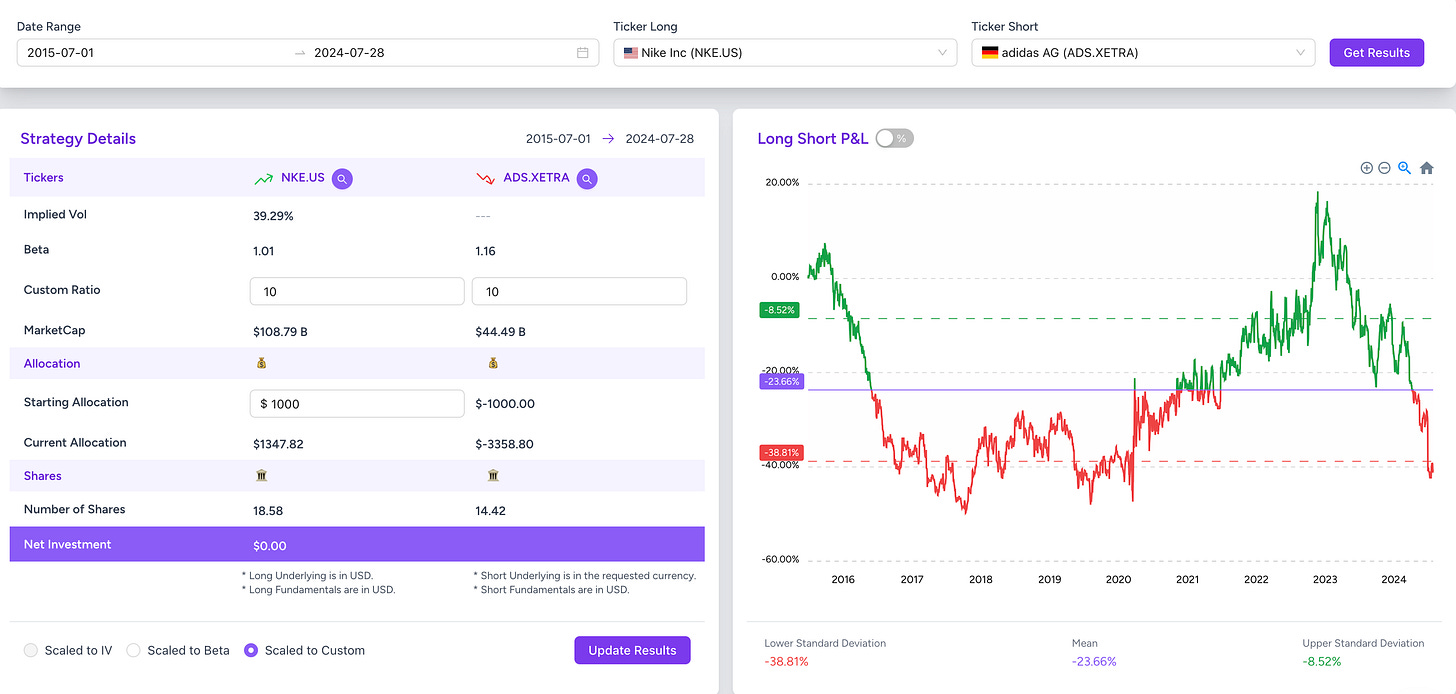

This strategy is currently positioned around the lower standard deviation, a level not seen since 2020. We believe this presents a compelling opportunity for a long/short trade in this pair once again.

ADS SLB rate stands, at the time of this writing, around 0,56% at IBKR.

At the time of this writing, Nike is trading at $73.70 per share, while Adidas is trading at €236.80 per share on the IBIS exchange.